nj tax sale certificate premium

As a seller of taxable goods or services you are required to be registered with the New Jersey Division of Revenue and Enterprise Services. Most auctions are in person call out.

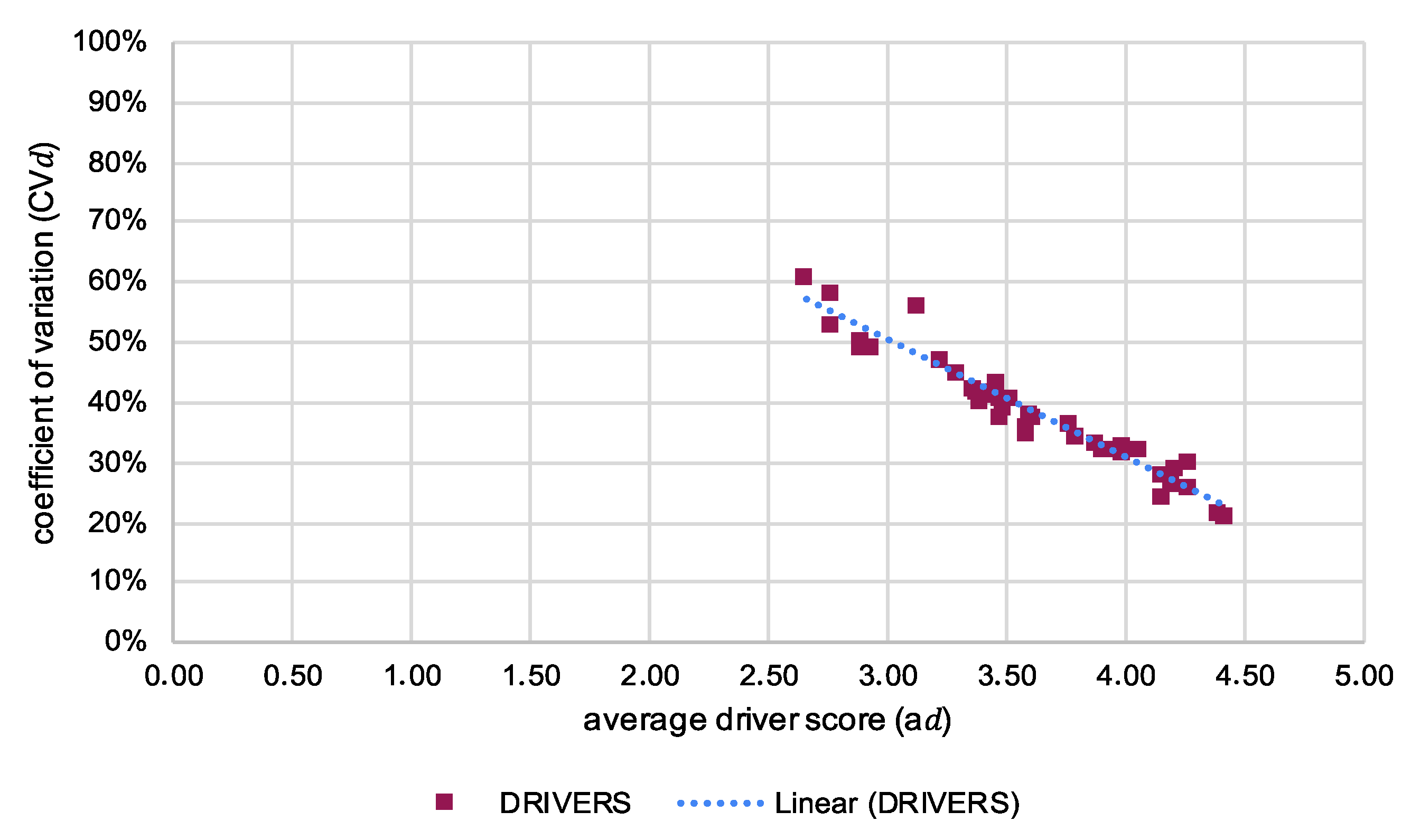

Sustainability Free Full Text Identifying Public Policies To Promote Sustainable Building A Proposal For Governmental Drivers Based On Stakeholder Perceptions Html

If you invest in tax sale certificates be mindful of the complexities of the governing state law when you file a bankruptcy proof of claim on account of the certificate.

. There are 2 types of tax sales in New Jersey. Sales and Use Tax. Bidding stops to obtain the tax.

New Jersey is a good state for tax lien certificate sales. Title Practice 10117 4th Ed. We have 566 municipalities each of which has its own tax sale.

For a listing of. In NJ the lenders policy expense is only a small fee of the owners title insurance premium. Redemption of tax sale certificates TSCs can present difficulties for buyers and sellers as well as for their attorneys and title companies.

Once you have that. Now about 10-20 or so are on. According to New Jersey Law on tax lien certificate greater than 200 a penalty of 2 is added to the tax lien certificate tax lien certificates greater than 5000 bring a 4 penalty and tax.

If the interest is bid down to 1 a premium is bid up until the bidding stops to obtain the tax sale certificate. The purchaser must complete all fields. So now there could be a tax sale certificate sale that would place a lien on the house because of a previously held New Jersey Tax Sale Certificate Auction.

The Township of Willingboro announces the sale of 2020 and prior year delinquent taxes and other municipal charges through an on-line auction. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Once registered you must display your.

Electronic Municipal Tax Sales Online LFN 2018-08 Adoption of NJAC 533-11 creating regulations for long standing PILOT program for internet-based tax sales. Contracts considered professional service. The Plaintiff in a tax sale foreclosure.

2016 and prior. Select A Year. 30 rows Sales and Use Tax.

New Jersey Sales and Use Tax Energy Return. Ad Integrates Directly w Industry-Leading ERPs. Tax sale is the enforcement of collections against a property by placing a lien against the property for all outstanding municipal charges due at the end of the calendar year December 30.

Elements of Tax Sales in New Jersey New Jersey law requires all 566 municipalities to hold at least one tax sale per year if the municipality has delinquent. Reduce audit risk as your business gets more complex. New Jersey is unusual in that the interest rate is bid down and once the interest is bid down to 0 premium is then bid.

18 or more depending on penalties. This post discusses only those tax sale foreclosures completed by individual non-municipal TSC holders. The accelerated tax sale is held prior to the end of.

The following UEZ businesses have qualified for the sales and use tax exemption available for purchases of natural gas electricity and the transportation and transmission of both. Purchasing a tax sale certificate is a form of investment. The standard tax sale is held within the current year for delinquent taxes of the prior year.

Ad Download Or Email NJ ST-3 More Fillable Forms Register and Subscribe Now. Here is a summary of information for tax sales in New Jersey. This means that the investor is getting no interest on the certificate.

Tax Sale September 15 2021. New Jersey Sales Tax Certificate information registration support. New Jersey assesses taxes on the local municipal level.

Ad Fill out a simple online application now and receive yours in under 5 days. New Jersey offers grants incentives and rebates to businesses and every recipient must obtain a business assistance tax clearance certificate from the Division of. Nj tax sale certificate premium Monday February 14 2022 Edit.

Ad Fill out a simple online application now and receive yours in under 5 days. Ad New State Sales Tax Registration. Completed New Jersey Resale Certificate Form ST-3 or Streamlined Sales and Use Tax Agreement Certificate of Exemption Form ST-SST.

So in the above. Lands listed for sale. Discretion of tax collector as to sale.

Earth Free Full Text Do Sustainability Standards Exclude Small Farms Modelling The Kenyan Floricultural Sector Html

Protect Social Work In New York Take Action Now Governor Supports Permanent Exemption From Social Work L Personal Development Plan Social Work Take Action

Real Estate Related Services Design De Arte

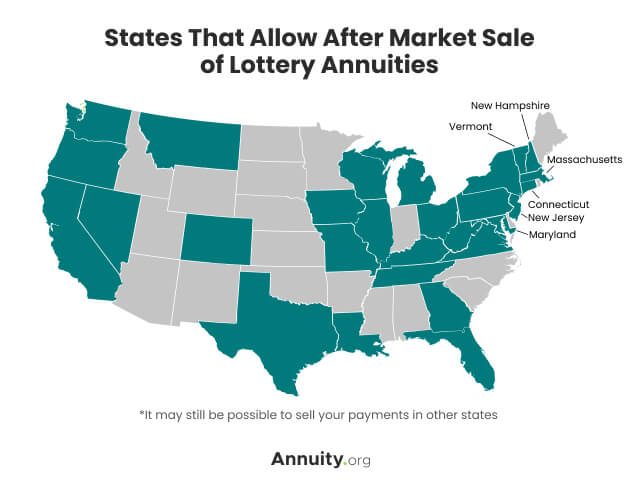

Annuity Taxation How Various Annuities Are Taxed

Tax Officers Can Issue Certificates To Avoid Taking Tds From Nris Mint

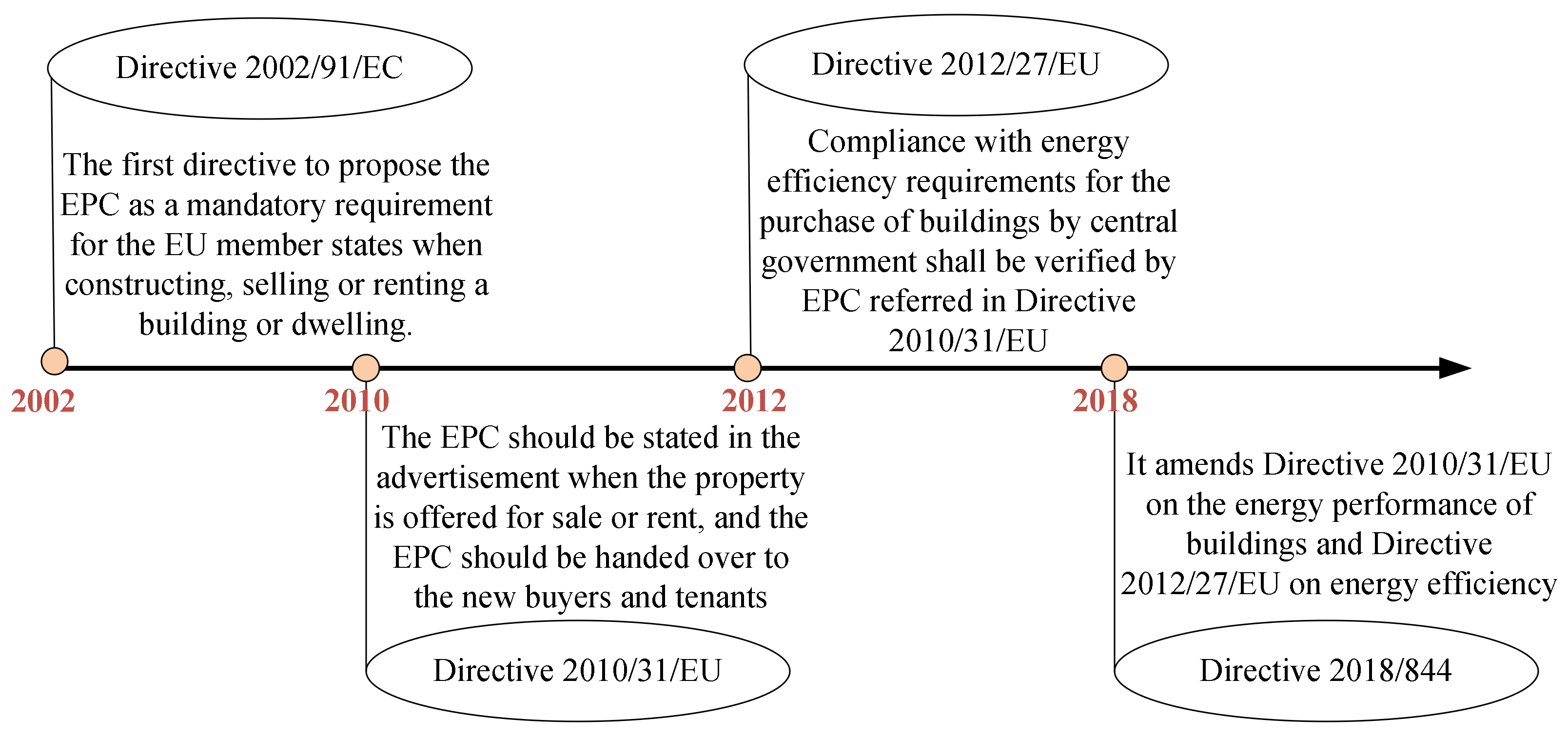

Sustainability Free Full Text A Critical Review Of Sustainable Energy Policies For The Promotion Of Renewable Energy Sources Html

Image Result For Nonprofit Donation Letter For Tax Receipt Donation Letter Template Donation Thank You Letter Donation Letter

Elite Checks Order Checks Online Personal Checks Checks